When you pick up a bottle of generic metformin, amoxicillin, or blood pressure medicine, there’s a good chance the active ingredient inside came from a factory in China. As of 2024, Chinese manufacturers produce 78% of the world’s active pharmaceutical ingredients (APIs) - the essential building blocks of nearly every generic drug on the planet. That’s not just a big number. It’s a system that keeps medicine affordable. But behind the low price tag lies a complex web of quality risks, regulatory gaps, and supply chain vulnerabilities that could affect your health without you ever knowing.

Why China Dominates Generic Drug Production

China didn’t become the world’s top API producer by accident. After joining the WTO in 2001, the government poured billions into building chemical manufacturing hubs, offering tax breaks, cheap land, and relaxed environmental rules. By 2023, Chinese factories were churning out 500 to 2,000 metric tons of APIs per year - far more than any other country. Companies like Sinopharm and Huahai Pharmaceutical mastered high-volume, low-cost production, especially for simple molecules like antibiotics and diabetes drugs. The secret? Vertical control. Chinese manufacturers own nearly 70% of their supply chain - from raw chemicals to final API. They buy key starting materials (KSMs) in bulk, often from state-owned suppliers, cutting out middlemen and reducing costs by 30-40% compared to U.S. or European producers. A kilogram of API made in China might cost $80. The same thing made in the U.S. or Germany? $300 or more. This isn’t just about money. It’s about scale. When a global shortage hits - like during the pandemic - China’s factories can ramp up faster than anyone else. But that same scale creates a dangerous single point of failure. If one major plant shuts down, millions of prescriptions could be delayed.The Quality Gap: What the FDA Keeps Finding

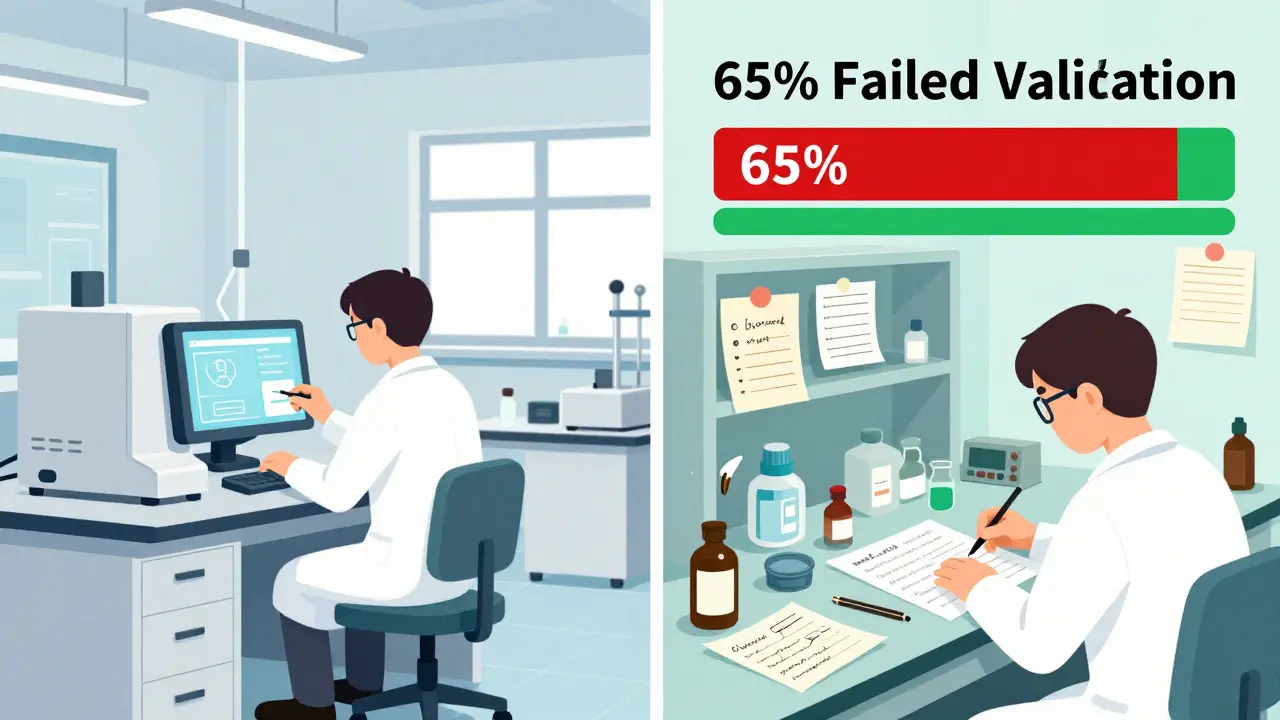

Cost isn’t the only thing China exports. So are quality problems. Between 2022 and 2023, the U.S. Food and Drug Administration (FDA) issued warning letters to Chinese API plants citing consistent failures:- 78% had inadequate lab controls - meaning they didn’t properly test batches for purity or strength

- 65% didn’t validate their manufacturing processes - so they couldn’t prove each batch was identical

- 52% had data integrity issues - including deleted records, backdated logs, or fake test results

Why Quality Control Falls Short

You might think, “If the FDA inspects these plants, why does this keep happening?” The answer is simple: they can’t inspect enough. The FDA inspects Chinese facilities at one-tenth the rate of U.S. plants. Why? Access. Chinese regulators don’t always allow full, unannounced inspections. Travel restrictions, bureaucratic delays, and limited translator access make it hard for FDA teams to get in and out quickly. Dr. Margaret Hamburg, former FDA Commissioner, said in 2024: “We’re flying blind on a huge portion of our drug supply.” Even when inspections happen, many Chinese plants still use outdated batch processing methods. While U.S. and European factories have moved to continuous manufacturing - a more precise, real-time system - 65% of Chinese API production still relies on old-school batch methods. That means more variation between batches, more risk of contamination, and harder-to-detect errors. Another problem? The training gap. Many quality control staff in Chinese plants aren’t trained to international standards. Documentation is often done in Chinese, with poor translation. One pharmaceutical procurement manager told a 2023 PwC survey: “We spent six months just figuring out what the lab reports meant. Half the time, the numbers didn’t match the actual test data.”

China’s Response: The Generic Consistency Evaluation

China isn’t ignoring the problem. In 2016, the National Medical Products Administration (NMPA) launched the Generic Consistency Evaluation (GCE) program. The goal? Make sure Chinese generics perform the same as brand-name drugs in the body. It’s a step in the right direction. Since then, 4,500 non-compliant factories have been shut down. The number of generic drug manufacturers dropped from 7,000 to just 2,500. The NMPA says 95% of GMP-certified plants now follow ICH Q7 guidelines - international standards for good manufacturing. But here’s the catch: only 35% of approved generic drugs have completed the full GCE process as of 2024. That means most generics on the market still haven’t been proven to work the same as the original. And the program doesn’t cover APIs - only finished pills. So even if the tablet is good, the active ingredient inside might still be flawed. Plus, China’s priority review system gives faster approval to drugs made for the domestic market - not exports. That means companies focus on passing local inspections, not FDA or EMA standards.The Global Domino Effect

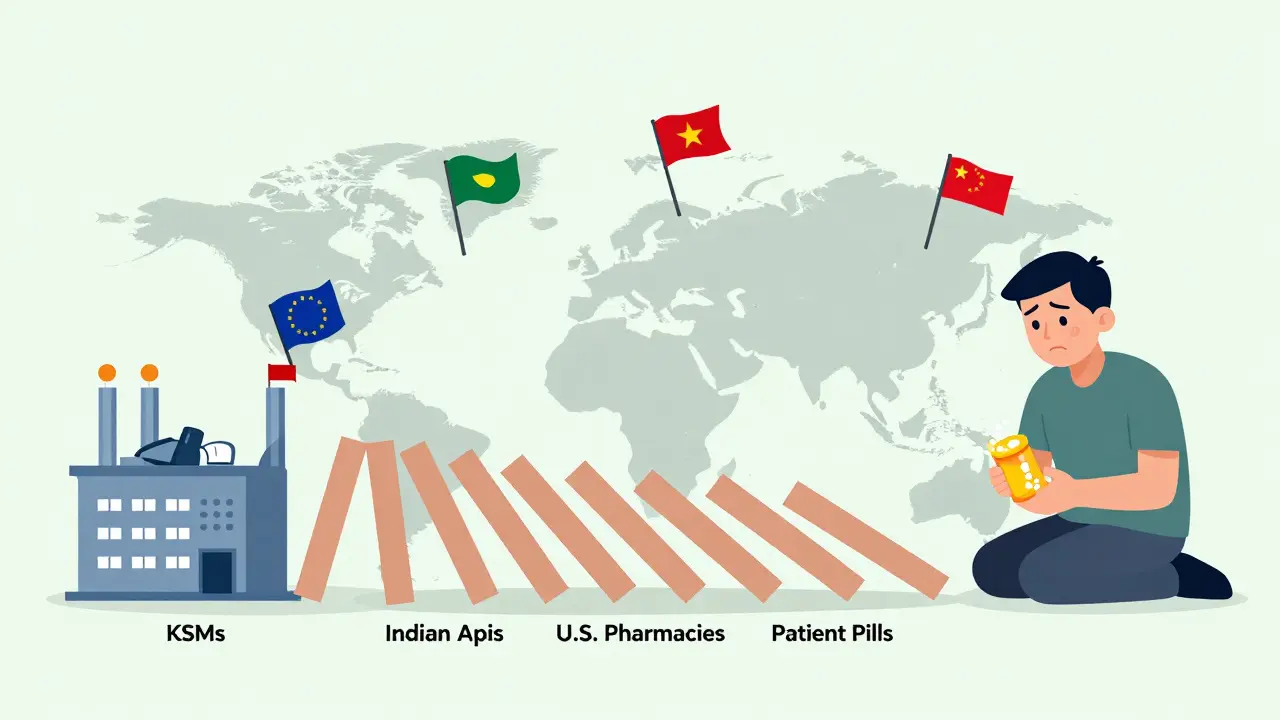

China doesn’t just make APIs - it makes the ingredients that make the ingredients. Over 80% of the world’s key starting materials (KSMs) come from China. That’s the raw chemical foundation for everything from antibiotics to heart medications. India, the second-largest generic drug producer, imports 65% of its APIs from China. So even if you buy an “Indian-made” generic, it’s likely built on Chinese chemistry. If China cuts off exports - whether due to trade war, pandemic, or factory fire - the entire global generic supply chain could collapse. Dr. Andrew von Eschenbach, former FDA Commissioner, warned in 2023: “China controls 90% of the KSMs for essential medicines. That’s not a supply chain. It’s a single point of failure.” That’s why the U.S. and EU are now trying to diversify. The U.S. CHIPS and Science Act allocated $500 million to rebuild domestic API production. The EU’s 2024 Pharmaceutical Strategy aims to cut China’s share of API imports from 80% to 40% by 2030. Vietnam, Mexico, and India are stepping up with new facilities - but they’re years behind in scale and cost efficiency.

Medications

Medications

Cecelia Alta

January 11, 2026 AT 17:05Okay but like… if my blood pressure med costs $4 and I’m not dropping dead, why are we even having this conversation? I’m not paying $300 for a pill just so some FDA bureaucrat can feel better about themselves. My grandma took Chinese metformin for 12 years and still beat cancer. Stop panic-selling fear like it’s a TikTok trend.

laura manning

January 13, 2026 AT 10:00The data is unequivocal: the FDA’s 2023 failure rate for Chinese-sourced APIs stands at 12.7%, compared to 1.8% for U.S.-sourced equivalents-a statistically significant disparity (p < 0.001). Furthermore, the absence of real-time continuous manufacturing in 65% of Chinese facilities introduces unacceptable batch-to-batch variability, directly contravening ICH Q7 guidelines. The regulatory oversight deficit-inspections conducted at one-tenth the rate of domestic facilities-is not merely a logistical shortcoming; it is a systemic public health liability.

Jay Powers

January 15, 2026 AT 07:32I get the fear but we can’t just throw the baby out with the bathwater. China’s got the scale and the cost that keeps medicine accessible to millions. Maybe we should be pushing for better inspections instead of panic-buying Indian meds that cost 3x more. I’ve seen hospitals switch and the savings vanished overnight. We need smarter rules, not isolation.

Lawrence Jung

January 16, 2026 AT 12:01It’s not about China or the FDA or even APIs-it’s about the illusion of control. We outsourced the building blocks of life to a system we don’t understand because it was cheaper. Now we’re shocked when the foundation cracks. But we built this. We chose convenience over caution. The real question isn’t who makes the pills-it’s why we stopped caring who made them

beth cordell

January 18, 2026 AT 08:55so like… i just got my amoxicillin from CVS and it’s from india?? but the api? 🤔 china 😭 i feel like my body is a puppet show and i’m not even the puppet master. 🤡💊 #pharmageddon #wheredidthemedscomefrom

Rinky Tandon

January 19, 2026 AT 00:17The GCE program is a performative gesture. Only 35% of generics are verified? That’s not regulation-that’s theater. And the KSM dependency? 80% of precursors from one country? That’s not a supply chain, it’s a chokehold. The Indian manufacturers are just middlemen with better PR. Until the NMPA enforces GMP with teeth and transparency, this entire ecosystem is a house of cards built on wishful thinking and expired lab reports.

Ben Kono

January 19, 2026 AT 10:55My uncle’s a pharmacist in Ohio and he says half the time the batch numbers don’t even match the label. They just slap on whatever’s in stock. I’ve seen people get sick because the potency was off. We’re not talking about a headache-we’re talking about heart attacks and seizures. This isn’t a debate. It’s a waiting game

Cassie Widders

January 20, 2026 AT 18:25Interesting. I didn’t know most of my meds came from there. I guess I just trust the pharmacy. Maybe I should ask next time.

jordan shiyangeni

January 21, 2026 AT 05:32Let’s be brutally honest: we sacrificed safety for savings. We allowed a regime with zero regard for human life to become the gatekeeper of our medicine. We didn’t just outsource manufacturing-we outsourced our moral responsibility. And now we’re surprised when people die because a batch was under-potent? That’s not negligence. That’s complicity. Every time you buy a $4 generic without asking where it came from, you’re choosing profit over life. And that’s not just irresponsible-it’s evil.

Abner San Diego

January 21, 2026 AT 17:03China’s got 78% of the market because they work harder. We’re weak. We want everything cheap and perfect but we won’t pay for it or build it ourselves. So now we cry when the pills don’t work? Wake up. This isn’t a conspiracy-it’s capitalism. If you want American-made drugs, pay $300. If you want to live, shut up and take the Chinese pill. We made this mess. Now deal with it.