When you take a pill for high blood pressure, an antibiotic, or a diabetes medication, there’s a good chance it came from India. The country doesn’t just make medicines-it supplies the world. More than 20% of all pharmaceuticals shipped globally by volume are made in India. That’s not a small number. It’s the backbone of affordable healthcare for billions. From rural clinics in sub-Saharan Africa to public pharmacies in the U.S., Indian generic manufacturers are the unseen force keeping treatment within reach.

How India Became the Pharmacy of the World

India’s rise wasn’t luck. It was strategy. In the 1970s, the country changed its patent laws. Before that, foreign drug companies held exclusive rights to their formulas. India said: no. If a drug was patented abroad, Indian companies could copy it-reverse-engineer it, make it cheaper, and sell it locally. This wasn’t piracy. It was policy. The goal? Make life-saving drugs affordable for Indians. The side effect? A global industry was born. By the 2000s, Indian firms had mastered the art of producing high-quality generics at a fraction of the cost. While branded drugs in the U.S. could cost hundreds or even thousands of dollars per month, the same medicine made in India often sold for under $10. That’s not a discount. It’s a revolution. Today, India has over 10,000 drug manufacturing units and more than 650 FDA-approved facilities-more than any other country outside the U.S. These aren’t small labs. These are large, modern plants that meet the same standards as those in Germany, Japan, or Switzerland. The World Health Organization recognizes over 2,000 Indian plants as WHO-GMP compliant. That’s the gold standard for global exports.What India Makes-and Who Uses It

Indian manufacturers don’t just churn out simple tablets. They produce complex formulations: extended-release capsules, injectables, transdermal patches, and even biosimilars-copies of expensive biologic drugs like those used for cancer and autoimmune diseases. Sun Pharma, Cipla, and Dr. Reddy’s don’t just make generics. They’ve built entire divisions focused on hard-to-make medicines. The numbers tell the story:- India supplies 40% of all generic drugs used in the United States.

- 33% of prescriptions filled by the UK’s National Health Service come from Indian manufacturers.

- Over 50% of medicines in sub-Saharan Africa are sourced from India.

- India produces more than 60% of the world’s vaccines, including those for polio, measles, and COVID-19.

Why India’s Prices Are So Low

The secret isn’t cutting corners. It’s scale, efficiency, and smart economics. Indian companies don’t spend billions on marketing or lobbying. They don’t need to. Their business model is simple: produce high volumes, keep overhead low, and sell to governments and bulk buyers who care about cost, not brand names. Labor costs are lower, yes-but that’s not the whole story. Indian manufacturers have spent decades perfecting production workflows. They’ve built supply chains optimized for bulk API processing. They’ve trained generations of chemists and engineers specifically for generic manufacturing. The result? A typical generic drug made in India costs 30% to 80% less than the same drug made in the U.S. or Europe. A 30-day supply of metformin for diabetes? Around $2 in India. In the U.S., it’s $15-$30 without insurance. A course of generic azithromycin? $5 in India. $60 in some American pharmacies. And it’s not just about price. The quality? It’s there. The FDA inspects Indian plants as often as American ones. In 2023, 85-90% of Indian facilities passed FDA inspections-on par with global averages. That’s a huge leap from 2015, when compliance hovered around 60%.

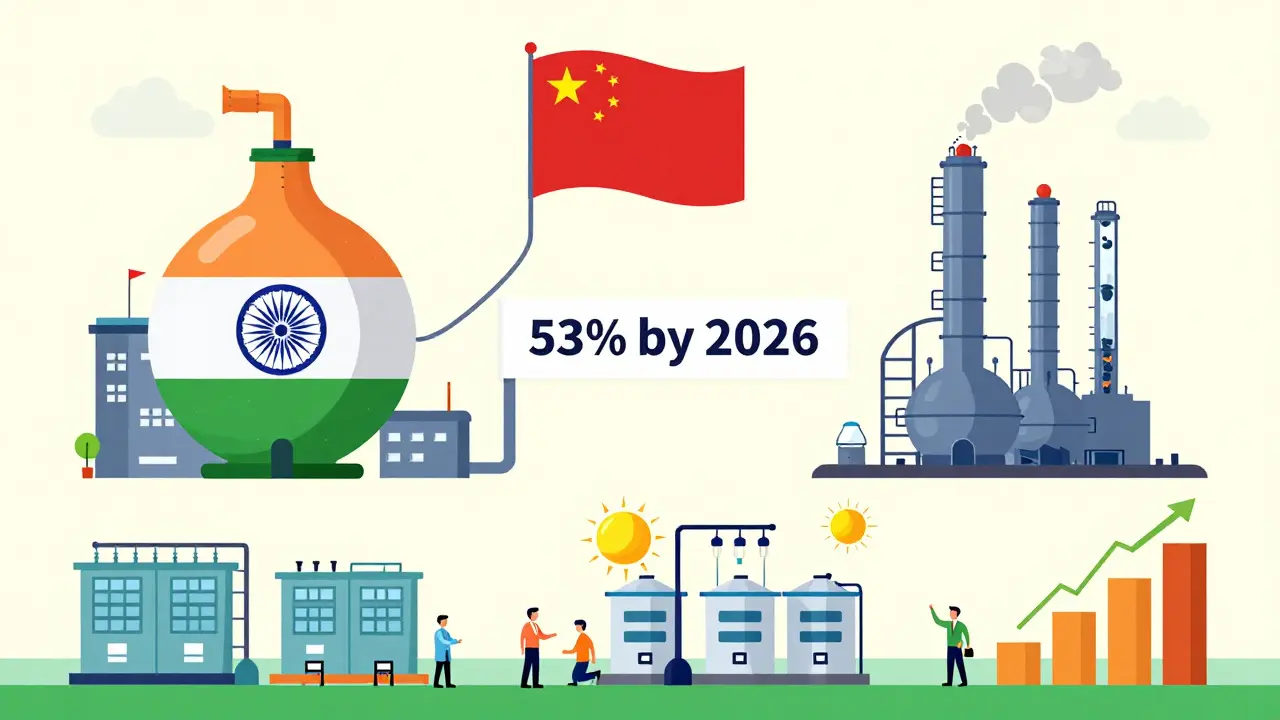

The Hidden Weakness: Dependence on China

For all its strengths, India has one major vulnerability: active pharmaceutical ingredients (APIs). These are the actual chemical compounds that make drugs work. India imports 70% of its APIs from China. That’s a problem. What if China cuts exports? What if a factory shuts down? What if geopolitical tensions disrupt shipping? During the pandemic, supply chain shocks caused shortages of antibiotics and antivirals worldwide. India felt it too. The Indian government is trying to fix this. In 2020, it launched a ₹3,000 crore ($400 million) Production Linked Incentive (PLI) scheme to boost domestic API production. The goal? Reach 53% self-sufficiency by 2026. So far, progress is slow. Building API plants takes years. The capital investment is huge. And Chinese APIs are still cheaper. Until India can make its own APIs at scale, it remains dependent on a single foreign source for the foundation of its entire industry.How India Compares to Other Generic Producers

China makes more drugs by volume, but its quality control is inconsistent. Only 153 Chinese plants are FDA-approved, compared to India’s 650. European companies like Teva and Sandoz make high-quality generics, but they’re expensive. They focus on niche markets and branded generics with higher margins. India’s edge? It does both: high volume and reliable quality. No other country can match its combination of scale, compliance, and low cost. But here’s the catch: India makes mostly low-value generics. It exports 20% of global volume, but only 10% of the global value. Why? Because it sells cheap. A $100 billion market in the U.S. has $30 billion in Indian exports by volume-but only $10 billion by value. That’s the gap. The smart companies are moving up. Biosimilars-copies of biologic drugs-are now 8% of India’s export value, up from 3% in 2020. Companies like Biocon and Dr. Reddy’s are spending over $500 million a year on R&D to develop these complex, high-margin products. That’s the future.

Real-World Problems and Patient Experiences

Most patients never know where their pills come from. And most don’t care-as long as they work. Surveys show 87% satisfaction among U.S. users of Indian generics on PharmacyChecker.com. People cite affordability as the #1 reason. But problems exist. In 2024, a Reddit thread detailed inconsistent dissolution rates in a batch of Indian-made levothyroxine-a thyroid medication. A few patients reported side effects. The FDA investigated. The batch was recalled. That’s how the system should work: a problem is found, it’s tracked, it’s fixed. In the UK, 12% of negative NHS reviews mention taste differences. In Africa, MSF reports 95% efficacy for Indian-sourced antimalarials. Shipping delays and packaging inconsistencies are common complaints on review sites-but these are logistics issues, not quality failures. The truth? The vast majority of Indian generics are safe, effective, and life-changing. A few bad batches don’t erase decades of proven results.The Road Ahead: From Pharmacy to Innovation Hub

India’s government has set a bold target: $190 billion in pharmaceutical exports by 2047. That’s not just about making more pills. It’s about making better ones. The focus now is on three things:- Reducing API dependence through PLI and local investment

- Scaling up biosimilars and complex generics

- Improving regulatory compliance to 95%+ across all export plants

FAQ

Are Indian generic drugs safe to use?

Yes, the vast majority are. Over 650 Indian manufacturing plants are approved by the U.S. FDA, and more than 2,000 meet WHO-GMP standards. Compliance rates have risen from 60% in 2015 to 85-90% today. While isolated quality issues occur-like any pharmaceutical industry-regulatory agencies actively monitor and recall unsafe batches. Indian generics are used by public health systems in the U.S., UK, Africa, and Latin America because they’ve been proven safe and effective over decades.

Why are Indian generic drugs so much cheaper than branded ones?

Indian manufacturers avoid the high costs that branded drug companies face: no massive R&D bills (they copy existing drugs), no expensive marketing campaigns, and no patent monopolies to defend. They produce in massive volumes, use efficient supply chains, and benefit from lower labor and operational costs. The result? Same active ingredient, same quality, 30-80% lower price.

Does the U.S. rely on Indian generic drugs?

Yes, heavily. India supplies about 40% of all generic drugs dispensed in the U.S., including common medications like metformin, lisinopril, and atorvastatin. Many U.S. pharmacies source these drugs directly from Indian manufacturers because they’re the most cost-effective option. The FDA inspects Indian plants regularly and has approved more facilities there than in any other country outside the U.S.

Is India the largest producer of vaccines in the world?

Yes. India produces over 60% of the world’s vaccines by volume. Companies like Serum Institute of India supply vaccines for polio, measles, rubella, and COVID-19 to more than 170 countries. During the pandemic, India was the primary source of global vaccine doses, especially for low- and middle-income nations.

What is the biggest challenge facing Indian generic manufacturers today?

Their dependence on China for 70% of active pharmaceutical ingredients (APIs). This creates supply chain risk. If China restricts exports due to trade tensions, natural disasters, or policy changes, India’s ability to produce medicines slows down. The government is investing billions to fix this, but achieving self-sufficiency will take years.

Do Indian companies make complex drugs like biosimilars?

Yes, and they’re becoming leaders. Companies like Biocon and Dr. Reddy’s are investing over $500 million annually in biosimilars-copies of expensive biologic drugs used for cancer, arthritis, and autoimmune diseases. India now accounts for 8% of global biosimilar export value, up from 3% in 2020. These drugs are harder to make than traditional generics but offer much higher profit margins and are the future of the industry.

Medications

Medications

Betty Bomber

January 27, 2026 AT 03:43Been taking Indian generics for my blood pressure for years. Never had an issue. My pharmacist said they’re FDA-approved, same as the brand-name stuff. Just cheaper. Why pay more when it does the same job?

Patrick Merrell

January 28, 2026 AT 18:48It’s not just about price-it’s about ethics. While Big Pharma rakes in billions, Indian companies are literally keeping people alive. The fact that we still question their quality says more about our broken system than theirs.

Mohammed Rizvi

January 30, 2026 AT 03:43Bro, we didn’t become the pharmacy of the world by accident. We reverse-engineered patents because our people were dying from $1000 pills. Now the whole damn planet uses our stuff. And yeah, we still import APIs from China-big deal. We’re fixing it. Meanwhile, you guys still pay $40 for insulin. 😒

eric fert

February 1, 2026 AT 03:24Let’s be real here. This whole narrative is a carefully curated PR campaign. Yes, India makes a lot of pills-but how many of those are actually bioequivalent? How many batches get recalled? The FDA inspection pass rate sounds good until you realize they’re inspecting the *best* plants-the ones that export. The ones making domestic Indian meds? Barely regulated. And don’t even get me started on the Chinese API dependency. This isn’t a success story-it’s a ticking time bomb wrapped in a flag.

Ryan W

February 2, 2026 AT 12:14India’s pharmaceutical dominance is a direct result of intellectual property theft. They didn’t innovate-they copied. And now they’re exporting that stolen technology to undermine American innovation. The U.S. spends billions on R&D, and India free-rides on it. This isn’t healthcare-it’s economic warfare.

Nicholas Miter

February 2, 2026 AT 14:59my grandma in texas gets her metformin from india for $2 a month. she says it works fine. no side effects. i checked the batch number on the FDA site-clean. if you’re worried about quality, check the actual data, not the fear-mongering. also-vaccines. 60% of the world’s vaccines come from india. that’s not luck. that’s skill.

Suresh Kumar Govindan

February 4, 2026 AT 04:16The reliance on Chinese APIs constitutes a strategic vulnerability of catastrophic proportions. The geopolitical calculus is unbalanced, and the lack of domestic synthesis capacity renders India’s entire pharmaceutical infrastructure susceptible to coercive export restrictions. This is not merely an economic concern-it is a national security imperative.

Aishah Bango

February 4, 2026 AT 11:41It’s immoral to celebrate a system built on exploiting cheap labor and lax environmental standards. We’re not saving lives-we’re outsourcing suffering. If we truly cared about global health, we’d pay fair wages and enforce real regulations-not just slap on a WHO-GMP sticker and call it progress.

bella nash

February 6, 2026 AT 10:30The irony is that the very model that enabled affordable medicine-reverse engineering-is now the barrier to India’s own evolution into a biotech leader. Innovation requires intellectual property protection. Yet without it, there is no incentive to invest in biosimilars. The system that saved the world may now prevent it from becoming something greater